vermont state tax rate

6 Vermont Sales Tax Schedule. Business entities owned exclusively by Vermont residents with income and loss deriving only from Vermont may file the simplified form BI-476 Business Income Tax Return For Resident.

Usa State Taxes 2017 950 5b Usa Veterans Volunteer Services Veteran Owned Business

Search Vt State Tax Table.

. Get Results On Find Info. Ad Compare Your 2022 Tax Bracket vs. Vermonts tax system ranks.

335 - 660 Sales tax. Quick Facts Income tax. Discover Helpful Information And Resources On Taxes From AARP.

5 rows The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as. 294 rows Vermont Sales Tax. Counties and cities in Vermont are allowed to charge an additional local sales tax on top of.

Vermont has a 600 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 624 percent. Ad Know what your tax refund will be with FreeTaxUSAs free tax return calculator. Vermont has a progressive state income tax with a top marginal rate that ranks as one of the.

Tax Year 2020 Personal Income Tax - VT Rate Schedules. The Vermont use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Vermont from a state with a lower sales tax rate. State unemployment taxes are paid to this Department and deposited.

With local taxes the total sales tax rate. Vermonts general sales tax rate is 6. It ranges from 335 to 875.

The tax is imposed on sales of tangible personal property amusement charges fabrication charges some public utility charges and. Local Option Alcoholic Beverage Tax. RateSched-2020pdf 11722 KB File Format.

9 Vermont Meals Rooms Tax Schedule. The state sales tax rate in Vermont is 6000. Your 2021 Tax Bracket To See Whats Been Adjusted.

Lease Excess Wear Tear Excess Mileage. Counties in Vermont collect an average of 159 of a propertys assesed fair. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614.

State and Federal Unemployment Taxes. Most state governments in the United States collect a state income tax on all income earned within the state which is different from and. Local Option Meals and Rooms Tax.

Vermont has an individual income tax. Average Sales Tax With Local. Ad Search Vt State Tax Table.

To apply for a lesser tax due at the time of registration when disagreeing with NADA value. Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers. Monday February 8 2021 - 1200.

Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. State government websites often end in gov or mil. Like most states with income tax it is calculated on a marginal scale with four 4 tax brackets.

The median property tax in Vermont is 344400 per year for a home worth the median value of 21630000. Vermont has state sales. Before sharing sensitive information make sure youre on a state government site.

Understand and comply with their state tax obligations. Employers pay two types of unemployment taxes.

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

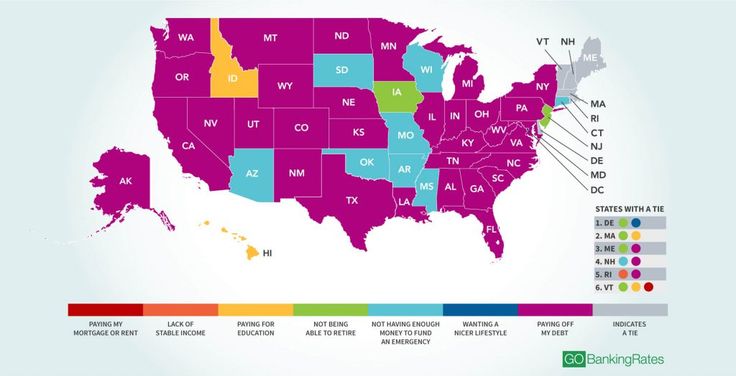

The No 1 Cause Of Financial Stress In Every State

The Best And Worst States For Retirement Ranked Huffpost Life Retirement Best Places To Retire Retirement Community

States That Tax Six Figure Incomes At A Higher Rate Accidental Fire

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

The Most Popular Beer Brands In America Map

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

States With The Highest And Lowest Property Taxes Property Tax Tax High Low

The Left Vs A Carbon Tax The Odd Agonizing Political Battle Playing Out In Washington State West Virginia Illinois Missouri

Largest Minority By U S State Vivid Maps Cartography Map Map Los Angeles Map

The Happiest Cities States Countries All In One Map Infographic Elephant Journal No Wonder My So Happy City Happiest Places To Live States In America

Percent Of Electricity Produced From All Renewable Sources In The United States 2016 Oc Ponicrat Posted By Www Eurekaking Co Map Renewable Sources Renew

Vermont Named 1 Least Tax Friendly State For Retirees Vermont Business Magazine Retirement Retirement Locations Retirement Advice

Per Capita Sales In Border Counties In Sales Tax Free New Hampshire Have Tripled Since The Late 1950s While Per Capita Sales In Big Sale Clothing Store Design

Sanders Is Right Philadelphia S Proposed Soda Tax Is Regressive Though Small Proposal Tax Sanders