south san francisco sales tax rate 2021

As we all know there are different sales tax rates from state to city to your area and everything combined is the required. San Francisco County California Sales Tax Rate 2022 Up to 9875.

Coffee And Community Improvement Districts Unpacking The Mystery Of The 7 Starbucks Macchiato Salon Com

The minimum combined sales tax rate for San Francisco California is 85.

. The Sales and Use tax is rising across California including in San Francisco County. Most of these tax changes were. A county-wide sales tax rate of 025 is applicable to localities in San Francisco County in addition to the 6 California.

Most of these tax changes. This is the total of state county and city sales. Look up 2021 sales tax rates for San Francisco Colorado and surrounding areas.

This is the total of state county and city sales tax rates. 1788 rows California City County Sales Use Tax Rates effective October 1 2022. Method to calculate South San Francisco sales tax in 2021.

What is the sales tax rate in South San Francisco California. The minimum combined 2021 sales tax rate for south san francisco california is. How much is sales tax in San Francisco.

The phone number for general tax questions is 1-800-400-7115. Go to our website at. Sales Use Tax Rates.

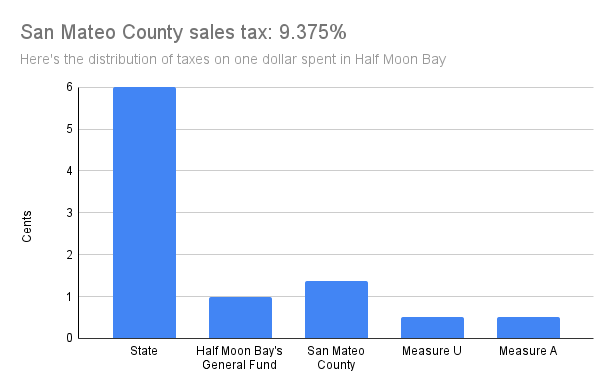

The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. California CA Sales Tax Rates by City S The state sales tax rate in California is 7250. Has impacted many state nexus laws and sales tax collection.

The San Francisco County sales tax rate is. The California sales tax rate is currently. Method to calculate San Francisco sales tax in 2021.

The minimum combined 2022 sales tax rate for San Francisco California is. City of South San Francisco. With local taxes the total sales tax rate is between 7250 and 10750.

The san francisco sales tax rate is 0. Santa Clara County This rate applies in all. Property taxes are collected by the County Tax Collector for the City and various other taxes are collected by the State and.

Wwwcdtfacagov and select Tax and Fee Rates. South Shore Alameda 10750. South San Francisco 9875.

The local sales tax rate in south san francisco california is 9875 as of november 2021. The 2018 United States Supreme Court decision in South Dakota v. How much is sales tax in San Francisco.

The average sales tax rate in California is. As we all know there are different sales tax rates from state to city to your area and everything combined is the. In San Francisco the tax rate will rise from 85 to 8625.

The minimum combined 2022 sales tax rate for South San Francisco California is. 0875 lower than the maximum sales tax in CA. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375.

The South San Francisco California sales tax is 750 the same as the California state sales tax. This is the total of state county and city sales tax rates. It was raised 0125 from 975 to 9875 in July 2021.

The 9875 sales tax rate in South San Francisco consists of 6 Puerto Rico state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. While many other states allow counties and other localities to collect a local option sales tax. South san jose hills ca sales tax rate.

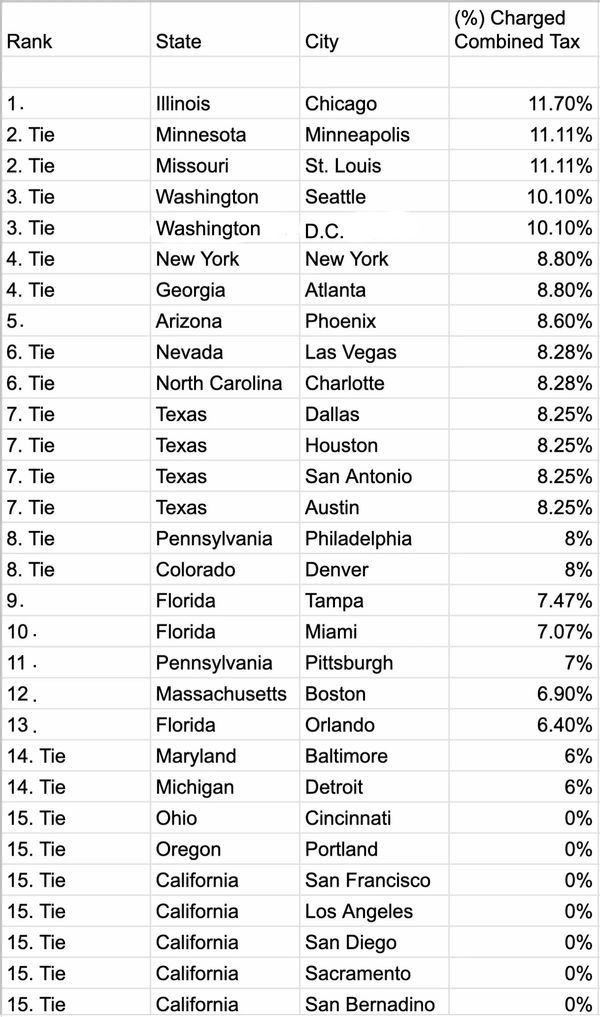

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Sales Tax Collections City Performance Scorecards

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

What Are California S Income Tax Brackets Rjs Law Tax Attorney

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

San Francisco Bay Area Apartment Rental Report Managecasa

Tracking The San Francisco Tech Exodus Sf Citi

California Income Tax Calculator Smartasset

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

/buying-vs-renting-san-francisco-bay-area-ADD-V2-d0efaf2b7ac346bbba2c1ac389751ef1.jpg)

Buying Vs Renting In San Francisco What S The Difference

Why Households Need 300 000 To Live A Middle Class Lifestyle

Taxes Fees Make Up 1 18 Per Gallon Of Gas In California Ktla

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

963 Ridgeview Ct Unit B South San Francisco Ca 94080 Mls Ml81897779 Redfin

California City And County Sales And Use Tax Rates Cities Counties And Tax Rates California Department Of Tax And Fee Administration